Base Features

Free Online Help

Request Support

Taxes within EasyCart are highly configurable and made to work in many international situations necessary for online eCommerce. Setting up taxes based on a country or state/province is easy, but we also provide special taxing situations for TaxCloud or TaxJar automated taxes, Canadian taxes, as well as VAT.

Special Note: All products have a tax setting that you should enable in order for tax calculations to work. Edit in the Product -> Taxes panel of each to either ‘Enable Tax’ or ‘Enable VAT’ so that they may be calculated. Failure to do so means the products themselves will not be taxed regardless of settings here.

In this video we walk through setting up state and country tax rates as well as global and duty taxes. WP EasyCart makes it easy to setup basic rates, and the flexibility and power to control individual product taxability.

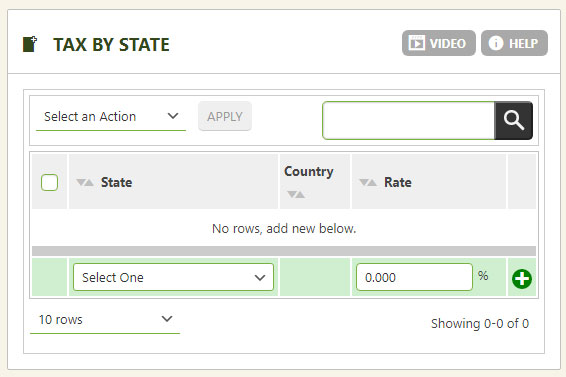

This section allows taxes to be calculated after the user enters their billing/shipping addresses based on their state/province. For validation purposes, it’s important to have your country and states within the billing/shipping screen be pulldowns so that valid state codes are selected. The country/state pulldown settings are found within the checkout options section.

To use, simply select a state and enter a tax percentage.

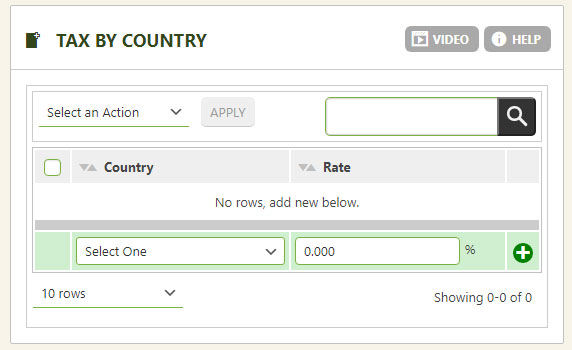

This section allows taxes to be calculated after the user enters their billing/shipping addresses based on their country. For validation purposes, it’s important to have your country and states within the billing/shipping screen be pulldowns so that valid country codes are selected. The country/state pulldown settings are found within the checkout options section.

To use, simply select a country and enter a tax percentage.

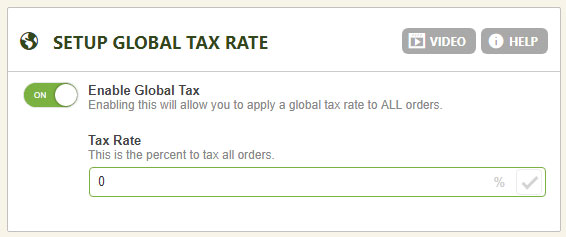

You can add a simple global tax rate on every country, state and order coming through EasyCart by setting this section with a single rate.

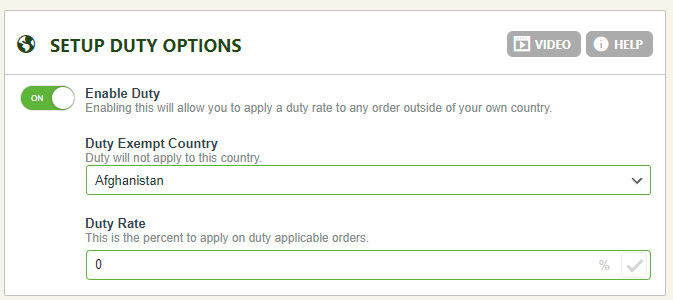

Customs or Duty charges can be additionally added as a special line item here to your checkout system in EasyCart. This is a seperate line item from Taxes or VAT and provides another customization point based on country setup. If looking for maximum flexibility, try our Flex-Fee system to create extra line-items based on country but other aspects such as city, postal code and various rate setups. Click Here for our Flex-Fee setup.

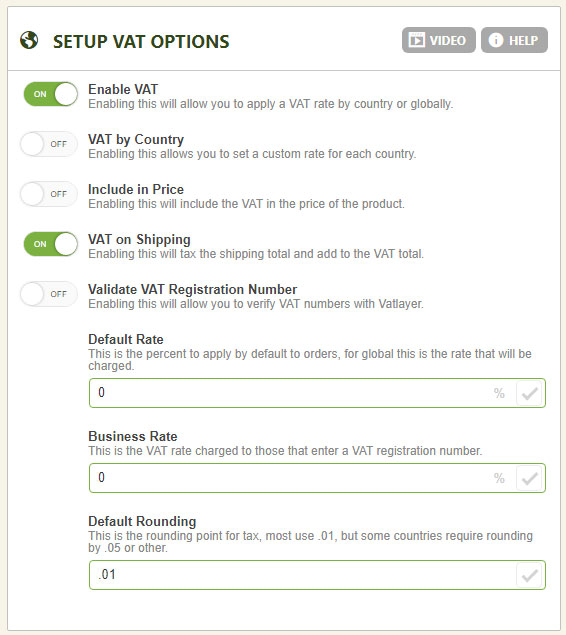

Value Added Tax is a complex system that we integrated with EasyCart for many European and Australian customers.

Video Guide – How to Setup VAT tax ratesMany countries require a VAT tax system and EasyCart makes it easy with this video tutorial. Walk through setting up individual country VAT rates, global VAT, as well as VAT registration collection and custom product inclusive/exclusive displays. |  |

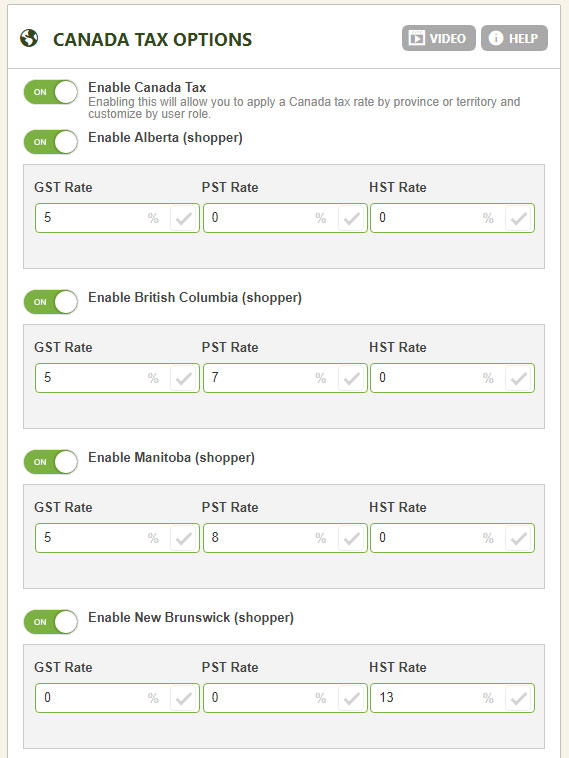

To have more flexibility with Canadian customers, EasyCart offers enhanced tax setup with each province able to have GST, PST or HST setups. You can also have different tax rates based on a user role you create within the accounts area.

Video Guide – How to Setup Canadian HST, GST, PST taxesCanada and several countries offer an HST, GST, PST tax based system and EasyCart makes it easy to set them up. Watch as we create a robust Canadian tax based system for an eCommerce store. |  |

To use simply enable Canada Tax option, and enable which provinces you wish to have enabled. Enter a GST, PST, HST rate for each area.

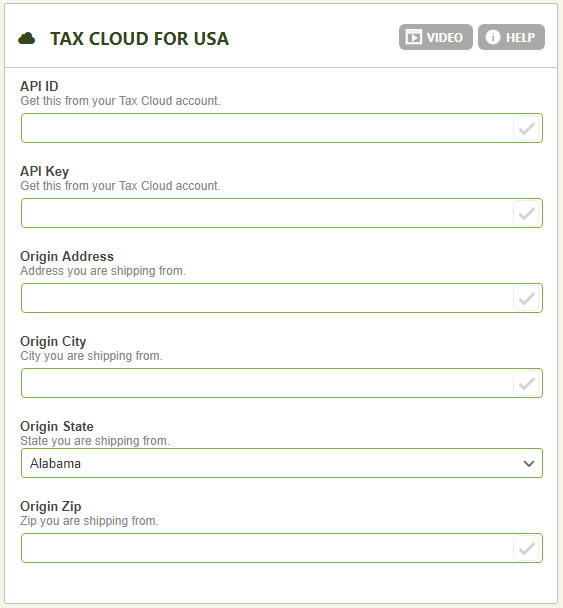

Tax Cloud is an automated service we have integrated with in EasyCart to allow precise taxes to be generated using their API. Enter all of your TaxCloud information to connect the system and it will return tax rates based on a products tax code and location. This is a good option when states require taxes based on county or even city level.

Video Guide – How to Setup TaxCloud API ServicesMany US customers need a robust state tax system and TaxCloud is integrated to provide just that. This video shows how to setup the API, apply custom product TIC identifiers, and allow TaxCloud to automate your tax needs. |  |

To use, simply go to taxcloud.com and get an account. Enter your details below.

Special Note: At the product level, you may also enter a tax code (TIC) for each product, which is sent to taxcloud as well for accurate tax generation. TaxCloud will calculate which type of product you are selling based on this TIC and give accurate readings for the types of products you sell based on those locations.

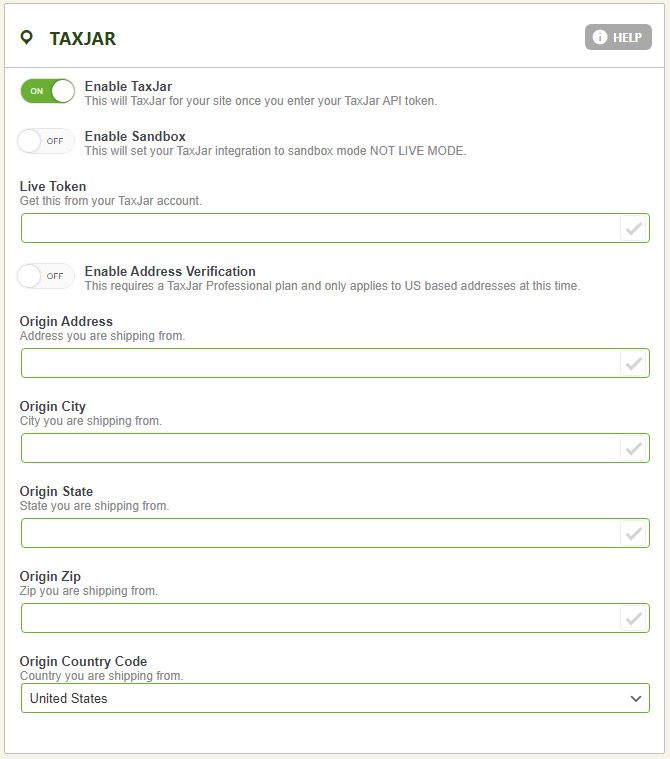

TaxJar is a popular API system that offers sales tax compliance for modern commerce systems. EasyCart allows you to easily connect to their API using a live token and it will retrieve tax rates based on your origin and location of users purchasing your goods. To get started, you will need to sign up for an account with TaxJar and retrieve your live API token available through their interface.

Simply paste your token into this section as demonstrated below. You may enable address verification as well. Then enter your origin address.